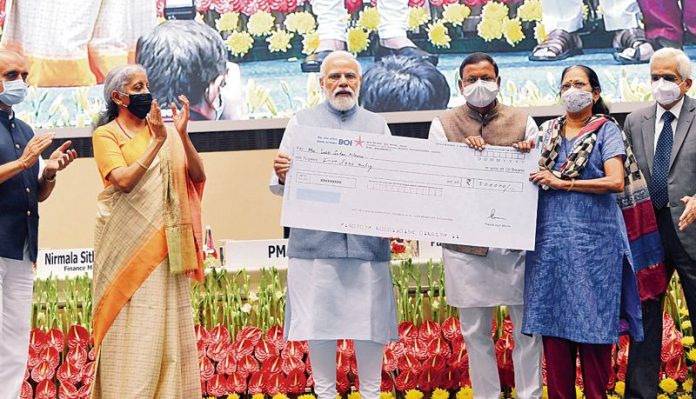

New Delhi: Money deposited in banks was absolutely safe, Prime Minister Narendra Modi said on Sunday as he announced that three lakh depositors, with accounts in banks under RBI restrictions, would soon receive the revised insurance amount of Rs 5 lakh.

“More than 1 lakh depositors have received over Rs 1,300 crore from 16 Urban Cooperative Banks that are under restrictions by the RBI,” the Prime Minister pointed out while addressing a function on “Depositors First: Guaranteed Time-bound Deposit Insurance Payment up to Rs 5 lakh”.

Rs1,300 crore payment given

More than 1 lakh depositors have got about Rs1,300 crore of their money with stressed banks in the past few days with the enactment of the Deposit Insurance and Credit Guarantee Corporation (Amendment) Bill. —Narendra Modi, Prime Minister

The PM was speaking ahead of a nationwide two-day banks’ strike on December 16 and 17 against the government’s proposed Bill for privatisation of two public sector banks (PSBs).

The Banking Laws (Amendment) Bill, 2021, which will facilitate the privatisation of two PSBs — said to be the Central Bank of India and Indian Overseas Bank — is part of 26 legislations the government intends getting approved in the ongoing winter session.

In the last session, Parliament had passed the General Insurance Business (Nationalisation) Amendment Bill, 2021, to enable the privatisation of government general insurance companies.

The PM appealed to the media to highlight the “beginning of a strong initiative” to return the money of depositors so that trust is generated in the banking system. Just like the media had highlighted the Swachh Bharat programme, it ought to prominently convey that the money of depositors was safe, he said.

“Not because Modi is saying so. But because depositors need to repose faith in the banking system,” he observed.

The PM declared that in “New India”, problems would not be brushed under the carpet.

“There was a time when depositors, especially fixed salary earners, entrusted their savings with banks. And when a bank went down, their lives turned dark. People would spend years trying to retrieve their money. These issues had no solution. Our government has been responsive and amended laws,” PM Modi said, while recalling that as a Chief Minister, irate depositors would hold him responsible if a bank collapsed.

“At that time, I had requested the Centre to increase the insured amount to Rs 5 lakh. My requests went unheeded. People have now sent me here and I have done it,” declared the PM.

In Depositors’ interest

Union Finance Minister Nirmala Sitharaman says depositors and their interests are kept high on the agenda of the Narendra Modi government at the Centre.