Calls for greater focus on Quality, Capacity Building and Timely Credit Flow

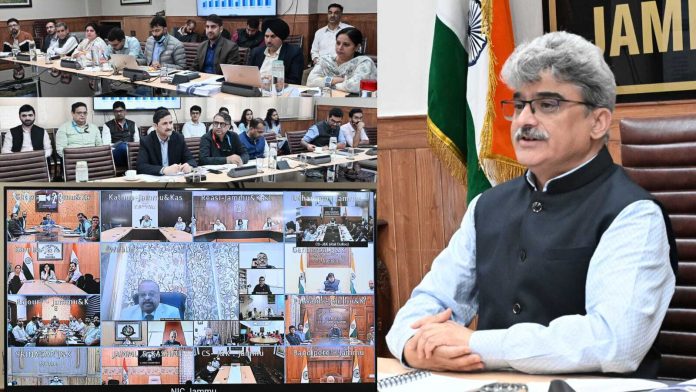

SRINAGAR: Chief Secretary, Atal Dulloo today chaired the Apex Level Committee meeting of Mission YUVA in Jammu, during which the progress of the mission was comprehensively reviewed and key directions were issued to further accelerate its implementation across the Union Territory.

The meeting besides Secretary, Labour & Employment, Kumar Rajeev Ranjan was attended by Principal Secretary, Finance, Santosh D. Vaidya; Vice-Chancellors of Universities; Commissioner Secretary, of H&UDD; Commissioner Secretary, Industries & Commerce; Commissioner Secretary, Cooperatives; Secretary, RDD; Director, IIM Jammu; Deputy Commissioners; Director, Colleges; CEO, CiTAG; representatives from J&K Bank, NABARD, IIT Jammu; and other concerned officers.

Reviewing the mission’s performance, the Chief Secretary underscored the importance of targeting specific potential groups such as college students, Self Help Group members (especially Lakhpati Didis), Vishwakarma-sponsored artisans, and existing nano-enterprises for their upgradation.

He directed departments to ensure that Detailed Project Reports (DPRs) are meticulously prepared to minimize the risk of business failure and stressed the need for continuous capacity building of applicants. He also emphasized hiring skilled manpower for the Project Management Unit (PMU) to ensure professional execution of the mission.

Calling upon banks to clear existing pendencies at the earliest, he urged them to play a proactive role in assisting applicants in DPR preparation, noting that the quality of DPRs is pivotal in translating ideas into sustainable enterprises.

He further asked financial institutions and departments to fast-track sanctioning and disbursement of loans so that eligible youth do not face delays in setting up their ventures.

Expressing satisfaction over the progress achieved so far, the Chief Secretary directed all stakeholders to work in synergy to scale up the mission’s outreach and impact.

Principal Secretary, Finance, Santosh D. Vaidya, in his remarks, underlined that the programme’s success hinges on three pillars including that of skilling of youth, financial support through banks, and strong market linkages. He stressed leveraging existing institutional mechanisms to ensure the goals remain practical and achievable.

Director, IIM Jammu, highlighted the need for a year-long activity calendar for capacity building of stakeholders, with timely listing of training topics and resource persons from reputed institutions.

Presenting the progress report, Secretary, Labour & Employment, Kumar Rajeev Ranjan, informed that Mission YUVA has so far received 42,334 applications including 36,951 for nano enterprises, 1,557 for new MSMEs, and 210 from existing MSMEs.

He further added that the mission has also recorded 90,611 registrations on the YUVA portal, of which 20,304 applications have been verified by Single Business Development Units (SBDUs) and 15,438 approved by District Level Implementation Committees (DLICs).

At the banking level, 15,771 applications involving projects worth Rs 1,071.43 Cr have been submitted. Of these, 4,190 applications have been sanctioned and 2,087 projects disbursed, reflecting strong momentum in youth-led entrepreneurship.

The average project cost, supported under the scheme, was said to stand at Rs 6.3 lakh, with banks sanctioning projects worth Rs 264.47 Cr, disbursing Rs 133.46 Cr, and subsidies worth Rs 23.18 Cr claimed so far.

Director, Employment, Shahzad Alam, further highlighted the strong digital engagement of the mission, with the YUVA mobile app crossing 50,000 downloads and the portal recording over 9 lakh visitors, positioning it as one of the most transparent and accessible platforms for youth empowerment in the UT.

Later, the Chief Secretary reviewed the live YUVA Dashboard, assessing district-wise performance on applications, credit flow, DPR generation, and youth skilling activities across blocks and municipal areas. He also reviewed the status of DLIC clearances, pendencies at banks, and the impact of Udyam Jagriti sessions being conducted across J&K.